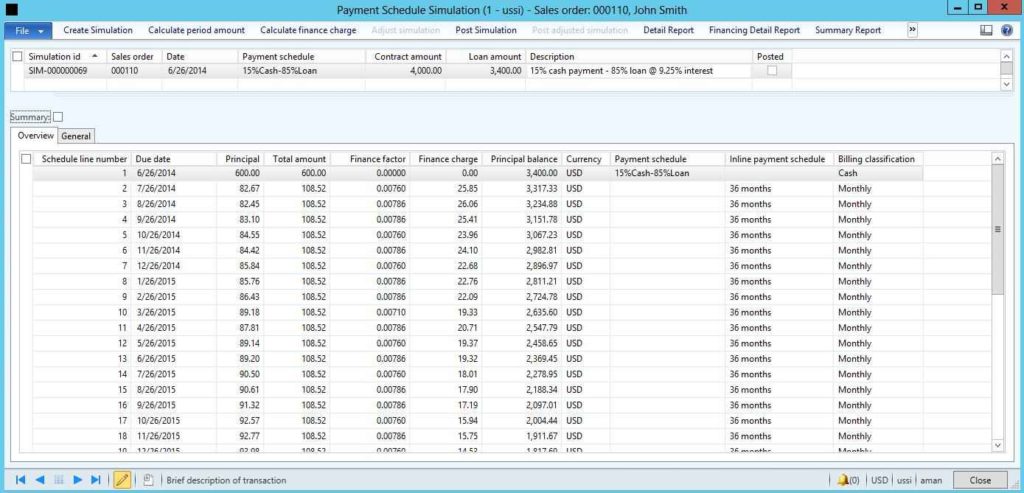

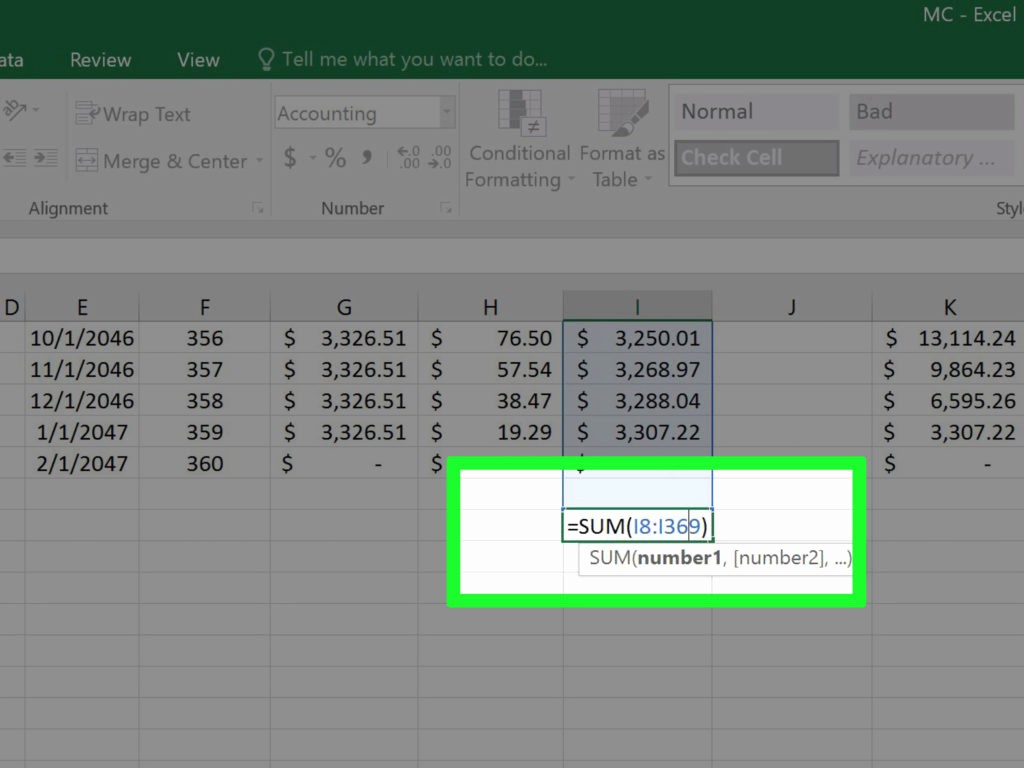

To calculate the amortization on a loan, you would apply the following formula: Along with this information, the amortization schedule shows you how much you have left to repay after each regular payment. The schedule shows the date and total amount of the payment, and also breaks down how much of that payment is going towards the principal versus how much is going towards the interest (and any other costs and fees). You can find more information about mortgage amortization along with some examples of total interest paid over short and long amortization periods elsewhere on our website.Īn amortization schedule is a table that lists out your regularly scheduled payments on a loan. In general, a longer amortization period means that you’ll have smaller regular payments, but you’ll pay more in interest over time, while with a shorter amortization period, the opposite is true.

Is a longer or shorter amortization period better? In this case, you can have an amortization period of up to 35 years. If you are able to make a down payment of 20% or more on your home, you have a conventional mortgage and do not require mortgage default insurance. The maximum amortization period for a high-ratio mortgage is 25 years. This protects your lender in the event that you are unable to pay your mortgage and default on the loan. If you are putting less than 20% down payment on your home, your mortgage loan is considered a high-ratio mortgage and will require mortgage default insurance (often known as CMHC insurance). How long does your amortization period have to be? The total amount of time that you have to pay off the principal of a loan is called the amortization period. Other examples of amortized loans include car loans and personal loans. When the principal has been repaid in full, the loan has been paid off. Part of the payment goes towards the interest on the loan (and things like mortgage default insurance and property taxes), while the rest goes towards the principal. An example of amortization that we commonly see is a mortgage - the homeowner takes out a mortgage loan and makes monthly payments to the lender. The most widely used meaning of amortization, which is what we are talking about here, is to regularly repay a loan over time.

LAND LOAN AMORTIZATION CALCULATOR HOW TO

Read on to learn more about what amortization is, how to understand an amortization schedule and how to use our amortization calculator. Whether you are taking out a mortgage or just about any other type of loan, you need to understand the concept of amortization.

0 kommentar(er)

0 kommentar(er)